哈佛/UCLA邀请赛 PF 11/12月辩题:

Resolved: The United States federal government should forgive all federal student loan debt.

1、与辩题有关的背景信息

1、How Much Student Loan Debt Does the Average College Graduate Have?

大学毕业生平均有多少学生贷款债务?

本文回顾了日益严重的债务问题。文章来自U.S.News,节选重点内容如下(想要获取全文完整内容请私信SD小助手):

Data reported to U.S. News by 1,012 colleges in an annual survey showed that graduates from the class of 2022 who took out student loans en route to a bachelor's degree borrowed $29,417 on average. That's about $2,200 more than borrowers from the class of 2012 had to shoulder, representing a roughly 8% increase in the amount students borrowed over that decade.

The average debt of graduates varies based on institution type, per U.S. News data. Those who graduated in 2022 from a ranked private college borrowed more on average, at $23,627, than public college graduates, who took out $20,371.

The average total student loan debt, which includes both federal and private loans, jumped more than $5,500 from 2009 to 2015, but in recent years the average amount borrowed has stabilized.

图片来自U.S.News

2、What is student loan forgiveness?

什么是学生贷款减免?

本文详细介绍了有资格获得减免的不同类型的贷款。文章内容来自Investopedia,节选重点内容如下:

Loan forgiveness means a debt (or part of a debt) is eliminated or forgiven in finance parlance—relieving the borrower of the obligation to repay it. Although any student loan can theoretically be forgiven, student loan forgiveness generally applies to U.S. government-issued or government-backed loans.

The highly publicized collapse of several for-profit colleges and the pandemic-induced 2020 economic crisis intensified longstanding concerns about the mounting burden of student debt. Broad loan forgiveness for all borrowers, not just those who work in public service, participate in a repayment plan, or have been defrauded by their college, has become a widely debated political issue.

2、与辩题有关最新政策和新闻

1、What They Are Reading in the States: More than 4 Million Student Loan Borrowers Enrolled in New Biden-Harris Administration SAVE Plan

超过 400 万学生贷款借款人加入了新的拜登-哈里斯政府 SAVE 计划

本文由白宫发布,节选部分重点内容如下:

The most affordable repayment plan ever, the SAVE plan will save millions of borrowers money on their monthly payments. Borrowers who earn less than $15 an hour will not be required to make payments, and anyone who does earn more will save more than $1000 on payments. The SAVE Plan also ensures that borrowers never see their balance grow due to unpaid interest as long as they keep up with their payments.

In Michigan, some 143,600 student loan borrowers already are set up to reduce their monthly payments through the brand new SAVE income-driven repayment plan, according to information released Tuesday by the U.S. Department of Education. The figure reflects both those who signed up on their own and those who were automatically shifted over from an earlier income-driven repayment plan, called REPAYE.

2、Student Loan Forgiveness FAQs: The Details, Explained

学生贷款减免常见问题解答:详细说明

本文来自Forbes,节选部分重点内容如下(想要获取全文完整内容请私信SD小助手):

SAVE is expected to significantly reduce the monthly payments of many low- and middle-income borrowers and provide a shorter path to loan forgiveness.

SAVE will be rolled out in stages, and all program features won’t be active until 2024. But the application for SAVE is now open, allowing the Department of Education to refine its processes before the program’s official launch.

Under that initiative, borrowers who earned less than $125,000 ($250,000 for married couples) would have been able to qualify for forgiveness of up to $10,000 of outstanding federal loans. Borrowers who received Pell Grants to pay for part of their education could have been eligible for up to $20,000 of loan forgiveness.

Following the Supreme Court ruling, the Department of Education is prohibited from forgiving any federal loans under this program.

3、662,000 Borrowers Get Student Loan Forgiveness As Improvements For Key Program Proceed

随着关键计划的进展,662,000 名借款人获得学生贷款减免

本文来自Forbes,节选部分重点内容如下:

Hundreds of thousands of borrowers have received student loan forgiveness under initiatives designed to improve Public Service Loan Forgiveness, according to the Biden administration.

Public Service Loan Forgiveness, or PSLF, is a key federal student loan forgiveness program that can eliminate a borrower’s federal student loan debt after 120 “qualifying payments” — the equivalent of 10 years. But the PSLF program has long been plagued by poor administration and inadequate oversight resulting in mistakes, rejections, and dismally low approval rates that never exceeded the low single digits.

Previously, only payments made on Direct federal student loans under a 10-year Standard or income-driven repayment (IDR) plan could count toward loan forgiveness. But the Limited PSLF Waiver allowed almost any period of repayment on any federal student loan to count as far back as October 2007, when PSLF was first created.

3、支持正方观点的相关资料

1、Ten reasons to cancel student loan debt. This reviews 10 major reasons to cancel the debt.

取消学生贷款债务的十大理由

本文回顾了取消债务的 10 个主要原因,节选部分内容如下(想要获取全文完整内容请私信SD小助手):

Student debt cancellation must be a federal priority for the new administration. As the devastating health and economic toll of the COVID-19 pandemic deepens, millions of student borrowers are held back by high levels of debt on top of job losses and the struggle to cover their basic needs. The pause on payments is only a temporary fix. Since student loan debt disproportionately impacts Black and Latinx borrowers, especially women, cancelling student debt is a racial and economic justice issue.

1. Student loan debt is a national crisis

2. Cancelling student debt would advance gender and racial equity

3. Cancelling student debt is good for the economy

2、Goldman Sachs has run the numbers on student-loan forgiveness. This is its assessment.

高盛统计了学生贷款减免的数据,这是它的评价

文章内容来自MarketWatch,节选部分重点内容如下:

The economists then drew on both Education Department data, as well as the Federal Reserve’s survey of consumer finances, to estimate the boost to income and consumption. Though lower-income households will see the largest proportional cut in debt payments, most of them don’t have student debt. The wealthy, on the other hand, are limited by the income thresholds attached to the relief. Middle-income households will benefit the most.

What’s the impact? Payments will fall from 0.4% of personal income to 0.3%. “This modest reduction in debt payments as a share of income implies only a modest boost to GDP. Relative to a counterfactual where debt forbearance ends and normal debt payments resume, our estimates imply a 0.1 percent point boost to the level of GDP in 2023 with smaller effects in subsequent years due to the natural maturation of student loans, as well as continued growth in nominal GDP,” they say.

图片来自MarketWatch

3、Erasing Student Debt Makes Economic Sense. So Why Is It So Hard to Do?

消除学生债务具有经济意义,那么为什么这么难呢?

文章内容来自TIME,节选部分重点内容如下:

Since the first pandemic-era stimulus package was enacted in March 2020, millions of Americans have been able to experience life free of the crippling burden of student-loan payments. The CARES Act paused payments on federal student loans and set a 0% interest rate on those loans through September 2020; the Biden Administration has extended that pause until September 2021, affecting some 42 million borrowers.

“Having the payment suspension is very helpful,” says Persis Yu of the National Consumer Law Center (NCLC). “But it makes them kind of realize what it might be like to not have student loan debt at all.”

4、支持反方观点的相关资料

1、Will student loan forgiveness make inflation worse?

学生贷款减免会让通货膨胀变得更糟吗?

文章内容来自Vox,节选部分重点内容如下(想要获取全文完整内容请私信SD小助手):

Larry Summers, a former Treasury secretary under President Bill Clinton, said on Twitter that student loan debt relief “raises demand and increases inflation.” Jason Furman, an economist at Harvard University and a top Obama administration economic adviser, tweeted: “Pouring roughly half trillion dollars of gasoline on the inflationary fire that is already burning is reckless.”

Conservatives have also attacked the policy and said it would fuel inflation. Mitch McConnell, the Senate minority leader, said the policy would “give away even more government money to elites with higher salaries” rather than help working families who are struggling to keep up with rising prices.

Many economists say it’s plausible for the policy to increase inflation. If people have less student loan debt to pay off, that frees up a portion of their budgets that they would otherwise spend on their loans. That might make people more likely to purchase things like new couches or cars. And as demand increases and consumers spend more, that tends to drive prices up.

2、Opinion: Canceling Student Loan Debt Would Really Only Benefit the Well-Off

观点:取消学生贷款债务实际上只会有利于富裕阶层

文章内容来自U.S.News,节选部分重点内容如下:

Student borrowers are a diverse group, ranging from unemployed college dropouts to high-earning medical school grads and MBAs. This wide range of individuals has different needs and challenges, and specific policies can be targeted and fine-tuned to provide relief to low-income borrowers struggling to repay their loans, without making massive payments to the affluent.

My research shows that 3 in 4 dollars from universal loan forgiveness will go to individuals in the top half of the income distribution – and that half of dollars will go to those in the top third of the income distribution. This means that there would be fewer resources for important government programs or for other payments benefitting the very poor, such as investments in education and increasing access to health care services.

3、Would Canceling Student Debt Promote Racial Equity?

取消学生债务会促进种族平等吗?

文章内容来自IHE,节选部分重点内容如下:

The nation’s $1.7 trillion in student debt is “disproportionately affecting Black Americans and communities of color,” Harrington, the group’s federal advocacy director, said during the discussion.

But while they understand the argument Harrington and others are making, some, like Sandy Baum, a senior fellow at the Urban Institute, see canceling that amount of debt for everyone with student loans as benefiting white borrowers more than Black borrowers.

Particularly when well-to-do white college graduates, able to pay back their loans just fine, would see tens of thousands of dollars in debt simply disappear.

其他秋季赛事正在报名中

UCLA邀请赛(12月2-4)正在报名中:

报名开始|UCLA辩论邀请赛「2023 UCLA Speech & Debate Invitational」

哈佛邀请赛(12月16-17)正在报名中:

正在报名|哈佛国际辩论锦标赛「Harvard Debate Council Intl Tournaments Dec 2023」

Resolved: The United States federal government should forgive all federal student loan debt.

2024哈佛&斯坦福邀请赛报名已经开始:

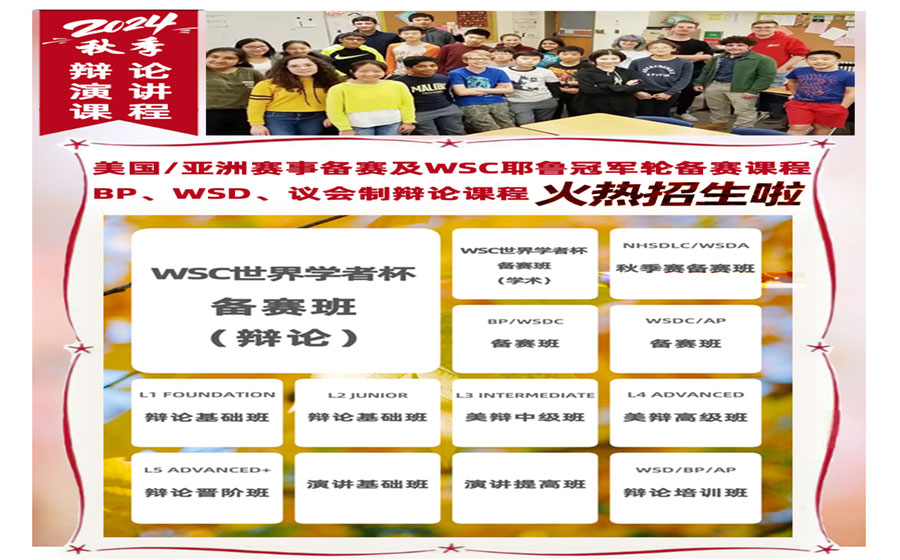

11/12月份美国赛事的PF辩论使用相同的辩题,我们为参赛的同学准备了专门的备赛辅导及资料,助力大家藤校摘星;秋季常规课程、WSC世界学者杯的耶鲁冠军轮备赛班也已同步开始:

2023秋季辩论/演讲课程|哈佛/耶鲁备赛及WSC耶鲁冠军轮备赛课程

美国藤校/亚太海外赛事时间表

UCLA邀请赛:12月2-3

普林斯顿大学精英赛:12月2-4

新加坡公开辩论赛:12月9-10

哈佛国际辩论锦标赛:12月16-17

哥伦比亚大学邀请赛:2024年1月26-28

伯克利国际议会邀请赛:2024年2月3-4

宾夕法尼亚大学精英赛:2024年2月10-12

斯坦福大学邀请赛:2024年2月10-12

哈佛大学锦标赛:2024年2月17-19

注:

上述赛事所安排的时间,除报名系统中特别注明外所标时间均为主办方所在地区的当地时间。

高含金量的美国、英国及亚洲国际性赛事,等你来战!

赛事报名

首次报名选手请扫描下方二维码,注册后提交辩手(或辩论队)信息报名;参加过赛事的选手可直接报名。咨询微信:

课程及备赛报名

首次报名选手请扫描下方二维码,注册后提交辩手(或辩论队)信息报名;参加过赛事的选手可直接报名。咨询微信:

辩论课程及备赛教练简介:

3、SD美国教练天团|屡获殊荣的辩论教练的教练Dr.Nick

5、SD美国教练天团|美国精英家庭的私人辩论教练-Shane

6、SD美国教练天团|全能型的辩论教练和写作导师-Anthony

成长的足迹|部分辩手专访:

冠军访谈|哈佛双冠王:两次哈佛国际辩论锦赛冠军Catherine,“自信坦荡,光芒万丈!”

冠军访谈|塔夫茨&哈佛国际辩论赛/哈佛 Junior Extemp 双料冠军周子心

冠军访谈|Isabel:刷新第49届哈佛锦标赛十六强/西雅图大学中学生锦标赛冠军最小年龄组记录

蝴蝶效应——从普通公立校辩论小白到哈佛Harvard Junior WSD冠军

成长的快乐:Harvard Junior JED冠军、西雅图大学锦标赛季军的成长之路

系列赛事报名及回顾:

赛报:西雅图大学辩论锦标赛冠、亚军|Seattle University Debate Tournament

赛报:哈佛国际辩论秋季赛冠军「Harvard Debate Council International Tournaments」

赛报:全美议会辩论联盟秋季赛优秀辩手 Top3|NPDL Fall Invitational 2023

赛报:31届耶鲁邀请赛VPF八强|31st Yale Invitational Tournament Int’l Quarter

赛报:亚洲青少年辩论锦标赛季军|Asia Junior Championship Summer 2023

赛报:WSC厦门全球轮总分冠军|2023世界学者杯World Scholar’s Cup 厦门全球轮 晋级耶鲁冠军轮

赛报:印度-太平洋世界学校辩论锦标赛季军|Indo-Pacific WSDC 2023

赛报:亚洲学校辩论公开赛打入决赛|BP赛事「Asia Schools Open 2023」

赛报:亚洲青少年世界学校辩论锦标赛亚军|Junior WSDC 2023

赛报:亚太青少年/亚太辩论锦标赛季军、八强|Asia Pacific Junior Debating Championships

赛报:平均年龄最小的WSC辩论冠军|2023世界学者杯World Scholar’s Cup

赛报:包揽3个组别冠军|Seattle University PF Debate Tournament

赛报:“收割式”获奖WSC合肥赛|2023世界学者杯World Scholar’s Cup

赛报:刷新哈佛锦标赛16强最小年龄记录|49th Harvard、37th Stanford、Tufts Harvard

赛报:塔夫茨&哈佛国际辩论锦标赛冠军|Tufts Harvard Debate Intl Tournaments

赛报:哥伦比亚大学邀请赛JV PF组八强+优辩|2023 Columbia University Invitational

赛报:哈佛PF冠军赛公开组辩手TOP 1|Harvard Debate PF Championships

赛报:哈佛 Junior WSD 冠军|Harvard Asian Junior Debate Tournament

赛报|伦敦政治经济学院BP锦标赛 LSE Debate Juniors:季军,优秀辩手第6名、第7名

赛报:哈佛 Junior Extemp 冠军|Harvard Asian Junior Debate Tournament

赛报|乔治城大学秋季赛:Novice LD组冠军,HS Junior Varsity LD组第三!

赛报:包揽冠亚季军|西雅图大学锦标赛SDcamps继续“霸屏”!

赛事简报|乔治城秋季赛:2支中国队首次打入该项赛事的淘汰赛,1支打入16强!

创造历史!西雅图战报:中国选手打入决赛获得亚军/中国辩手排名进入前2、前4!

赛事安排,常规课程及备赛课程内容及具体安排请加下方SD小助手微信咨询:

课程及赛事咨询

SDcamps•演辩营课程及赛事咨询,请添加小助手微信: